When it comes to securing a mortgage, finding the best rates is crucial for any homebuyer. Among the many options available, Navy Federal Credit Union stands out as a reputable and reliable choice. In this comprehensive guide, we will delve into the world of Navy Federal mortgage rates, providing you with all the information you need to make an informed decision and secure the best deal possible.

Whether you are a first-time homebuyer or looking to refinance your existing mortgage, understanding the intricacies of Navy Federal mortgage rates is essential. This guide will walk you through the various factors that influence these rates, the different types of mortgages offered by Navy Federal, and how to qualify for the best rates available.

Understanding Mortgage Rates

Factors Influencing Mortgage Rates

Mortgage rates are influenced by a variety of factors, including economic indicators, inflation, and the Federal Reserve’s monetary policies. Understanding these factors can help you make sense of the fluctuations in Navy Federal mortgage rates.

The Role of Credit Score

Your credit score plays a significant role in determining the mortgage rate you qualify for. Learn how Navy Federal assesses credit scores and discover strategies to improve your credit score to secure better rates.

The Impact of Loan-to-Value Ratio

The loan-to-value (LTV) ratio compares the loan amount to the appraised value of the property. Find out how the LTV ratio affects Navy Federal mortgage rates and how you can optimize it to your advantage.

Types of Navy Federal Mortgages

Fixed-Rate Mortgages

A fixed-rate mortgage offers stability and predictability as the interest rate remains constant throughout the loan term. Understand the benefits and drawbacks of choosing a fixed-rate mortgage from Navy Federal.

Adjustable-Rate Mortgages (ARMs)

ARMs offer initial lower interest rates that adjust periodically based on market conditions. Explore the features of Navy Federal ARMs, such as adjustment periods, rate caps, and how to evaluate whether an ARM is suitable for your needs.

VA Loans

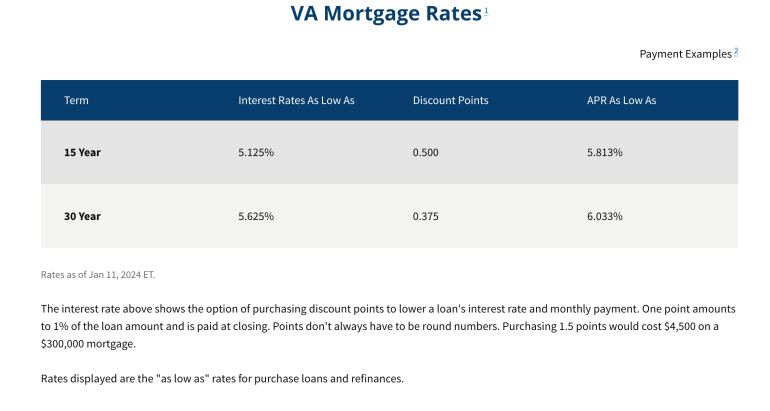

As a credit union serving military members and their families, Navy Federal offers VA loans with attractive benefits, including low or no down payment options and competitive interest rates. Discover the eligibility criteria and advantages of Navy Federal VA loans.

Jumbo Loans

Jumbo loans are designed for home purchases that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. Learn about Navy Federal’s jumbo loan options, including loan amounts, down payment requirements, and rates.

Current Navy Federal Mortgage Rates

Rate Overview

Stay up-to-date with the current Navy Federal mortgage rates across various loan types and terms. Get a snapshot of the rates available and gain insights into any recent rate trends.

Mortgage Rate Lock

Discover how mortgage rate locks work and why they are crucial in securing a favorable interest rate. Learn about the rate lock options provided by Navy Federal and the process of locking in your rate.

Factors Affecting Rate Fluctuations

Explore the factors that can cause Navy Federal mortgage rates to fluctuate, such as economic indicators, inflation, and global events. Understand how these factors may influence the rates you are offered.

Factors Affecting Navy Federal Mortgage Rates

Loan Term

Understand how the loan term affects Navy Federal mortgage rates. Determine whether a shorter or longer loan term aligns better with your financial goals and how it impacts the interest rate you’ll receive.

Down Payment

The down payment amount can influence your mortgage rate. Learn how various down payment options affect Navy Federal mortgage rates and explore strategies to optimize your down payment.

Loan Amount

Loan amount also plays a role in determining your mortgage rate. Discover how Navy Federal assesses loan amounts and how you can structure your loan to secure the most favorable rate.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio compares your monthly debt payments to your gross monthly income. Find out how Navy Federal evaluates DTI ratios and how it impacts your mortgage rate.

Tips for Securing the Best Navy Federal Mortgage Rates

Improve Your Credit Score

Learn strategies to boost your credit score and increase your chances of securing better Navy Federal mortgage rates. Explore techniques such as making timely payments, reducing debt, and correcting errors on your credit report.

Shop Around and Compare Offers

Don’t settle for the first mortgage offer you receive. Learn how to shop around for the best Navy Federal mortgage rates by comparing offers from multiple lenders. Understand the importance of obtaining loan estimates and analyzing them carefully.

Negotiate with Lenders

Discover effective negotiation techniques to secure more favorable Navy Federal mortgage rates. Understand how to leverage your financial strength, explore lender incentives, and negotiate terms that work in your favor.

Consider Different Loan Types

Explore the various mortgage options offered by Navy Federal and evaluate their impact on your mortgage rate. Consider factors such as loan term, down payment requirements, and interest rate structure to determine which loan type suits your needs best.

Mortgage Rate Comparison: Navy Federal vs. Other Lenders

Comparing Rates and Fees

Compare Navy Federal mortgage rates with rates offered by other lenders. Evaluate the fees associated with each lender to get a comprehensive understanding of the overall cost of borrowing.

Customer Satisfaction and Service

Consider factors beyond rates when comparing Navy Federal with other lenders. Explore customer reviews, feedback, and the quality of customer service provided by each lender to make an informed decision.

Additional Benefits and Services

Examine the additional benefits and services offered by Navy Federal and other lenders. Consider factors such as pre-payment options, online account management, and educational resources that can enhance your mortgage experience.

How to Apply for a Navy Federal Mortgage

Eligibility Criteria

Understand the eligibility criteria for Navy Federal mortgages, including membership requirements, credit score thresholds, and other factors that can impact your ability to qualify for a loan.

Required Documents

Prepare for the mortgage application process by gathering the necessary documents. Learn about the documents Navy Federal typically requires, such as income verification, bank statements, and tax returns.

The Application Process

Step-by-step, navigate through the Navy Federal mortgage application process. Understand what to expect, how to complete the application accurately, and the timeline for approval and closing.

Navy Federal Mortgage Refinancing Options

Benefits of Refinancing

Discover the potential benefits of refinancing your existing mortgage with Navy Federal. Explore how refinancing can help you lower your interest rate, reduce your monthly payments, or shorten your loan term.

Refinancing Process

Understand the steps involved in refinancing with Navy Federal, such as determining your goals, gathering documents, and submitting your application. Learn how the process differs from a traditional mortgage application.

Cash-Out Refinancing

Explore the option of cash-out refinancing offered by Navy Federal. Understand how it works, the eligibility requirements, and the potential benefits of accessing your home equity through a refinance.

Navy Federal Mortgage Rates: Frequently Asked Questions

Can I Get a Mortgage with Bad Credit?

Learn about the options available for individuals with less-than-perfect credit scores. Discover how Navy Federal supports borrowers with lower credit scores and explore strategies to improve your chances of approval.

Are Navy Federal Mortgage Rates Competitive?

Understand how Navy Federal mortgage rates compare to other lenders in terms of competitiveness and affordability. Explore data and customer experiences to assess the competitiveness of Navy Federal rates.

What Happens if Rates Change after I Lock?

Gain clarity on the implications of rate fluctuations after locking in your mortgage rate. Understand the options available to you if rates increase or decrease during the lock period.

The Benefits of Choosing Navy Federal for Your Mortgage

Excellent Customer Service

Explore Navy Federal’s reputation for providing exceptional customer service. Learn about their commitment to member satisfaction and personalized assistance throughout the mortgage process.

Flexible Terms and Options

Discover the flexibility offered by Navy Federal in terms of loan types, loan terms, and down payment options. Explore how their wide range of choices can help you find the mortgage that best aligns with your financial goals.

Additional Membership Benefits

Learn about the additional perks and benefits of becoming a Navy Federal member. Explore exclusive offers, discounts, and access to financial education resources that can enhance your overall banking experience.

In conclusion, securing a mortgage with favorable rates is essential for any homebuyer, and Navy Federal Credit Union offers competitive options worthconsidering. By understanding the factors that influence Navy Federal mortgage rates and following the tips shared in this comprehensive guide, you can make an informed decision and find the best mortgage deal that suits your needs and financial goals.

One of the key advantages of choosing Navy Federal for your mortgage is their commitment to excellent customer service. Navy Federal is known for providing exceptional support and guidance to their members throughout the mortgage process. Their experienced mortgage specialists are available to answer any questions you may have, provide personalized advice, and ensure that you have a smooth and stress-free experience from application to closing. Whether you are a first-time homebuyer or a seasoned homeowner, having a responsive and knowledgeable team behind you can make all the difference in securing the best mortgage rates and terms.

In addition to their outstanding customer service, Navy Federal offers flexible terms and options to meet a variety of needs. They understand that every borrower is unique, and their wide range of loan types, terms, and down payment options reflect this understanding. Whether you prefer a traditional fixed-rate mortgage for long-term stability or an adjustable-rate mortgage for initial lower rates, Navy Federal has options to suit your preferences. Furthermore, their VA loans provide exclusive benefits for military members and veterans, such as low or no down payment requirements and competitive interest rates. With Navy Federal, you can customize your mortgage to align with your financial goals and find a solution that works best for you.

As a Navy Federal member, you can also enjoy additional membership benefits beyond their mortgage services. Navy Federal offers a range of exclusive offers, discounts, and financial education resources to support their members’ overall financial well-being. From discounted insurance rates to special rates on auto loans and credit cards, being a Navy Federal member provides access to a wide array of financial advantages. Furthermore, their commitment to financial education ensures that you have the knowledge and tools to make informed decisions not only about your mortgage but also about your overall financial health. With Navy Federal, you are not just a customer, but a valued member of a community that prioritizes your financial success.

In conclusion, when it comes to securing a mortgage, Navy Federal Credit Union is an excellent choice. Their competitive rates, wide range of mortgage options, and exceptional customer service set them apart from other lenders. By understanding the factors that influence Navy Federal mortgage rates, comparing offers, and following the tips provided in this comprehensive guide, you can maximize your chances of securing the best possible mortgage deal. Whether you are a first-time homebuyer or looking to refinance, Navy Federal is there to guide you every step of the way. Consider the benefits of choosing Navy Federal for your mortgage needs and embark on your journey to homeownership with confidence.